top of page

Search

Why Average True Range Answers One Trading Question:“Is There Enough Room for Risk–Reward?”

Many traders focus on entries, indicators, or news — but ignore the most practical question in trading: Is there enough room for risk–reward? The Average True Range (ATR) answers this question better than almost any other indicator.Not because it predicts direction, but because it measures opportunity . In day trading and swing trading, ATR tells you whether a stock can realistically move far enough to justify the risk you are about to take. What Is ATR (Average True Range)

Paul Nawrocki

3 min read

Why Day Trading Stock Selection Matters More Than Strategy

Day trading success does not start with indicators or strategies.It starts with choosing the right stocks.

Paul Nawrocki

3 min read

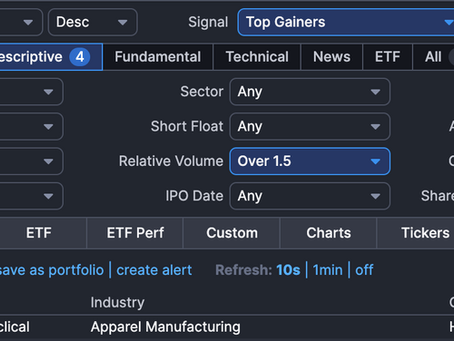

FinViz: Screener 1: General Top Gainers

The Top Gainers table in FinViz displays a list of stocks that are experiencing the largest price increases during the current trading day. While it is not the most important screener on its own, it provides a quick, high-level view of which stocks are attracting the most attention at the moment.

Paul Nawrocki

3 min read

Think Like A Trader

On page 171 of Mark Douglas' Trading in the Zone , the first long paragraph seems to be the summary of his book. The summary is not all, as we need some wider context to it, so we should read the book. However here is a short explanation for the most significant idea of trading. Trading Simplified: A Beginner’s Guide to How Trading Really Works When traders first enter the markets, they often believe that success comes from superior intelligence, advanced indicators, or predi

Paul Nawrocki

4 min read

Crowd Psychology: Fear and Greed in Day Traders Life

Discover how crowd psychology, fear, and greed drive day trading. Learn how FOMO, panic selling, and self-fulfilling patterns shape market moves—and how traders can turn crowd behavior into an advantage.

Paul Nawrocki

3 min read

The Day Trader’s Way

Discover the path of a day trader: how to recognize trading patterns, train intuition, and navigate the market’s unpredictable “highway.” Learn why mentorship and routine practice are the fastest road to consistent profits.

Paul Nawrocki

2 min read

12 Steps for Lost Traders. Mostly Day Traders

I’m writing about this so that you know there are remedies for a discouraged mind—and that they really exist. As you might guess, day...

Paul Nawrocki

3 min read

Are you a Technician or a Warrior?

Trading is less about knowledge and more about mindset. Discover if you are a technician or a warrior, and learn from Mark Douglas how a winning attitude separates successful traders.

Paul Nawrocki

2 min read

Breakeven Point – The Turning Point in a Day Trader’s Journey

Breakeven point is the critical stage for every day trader. STOP or RESTART? Learn how to turn losses into strategy and start growing instead of shrinking your account.

Paul Nawrocki

1 min read

Day Trading Training Cost Is Not a Cost. It’s Pure Profit.

Day trading training is not a cost but an investment. Learn on a professional platform and simulator with an experienced coach – no risk of losing capital.

Paul Nawrocki

1 min read

Don’t Force Trades – Tomorrow Is Another Day

In day trading, not every session offers real opportunities. Learn why it’s smarter to skip a day than to force trades and lose money in bad market conditions.

Paul Nawrocki

1 min read

Responsibility in Trading – How to Overcome Greed as a Day Trader

Responsibility and controlling greed are key to day trading success. Discover how a simple daily profit plan helped a beginner trader escape the trap of losses.

Paul Nawrocki

2 min read

My First Steps Into Day Trading

I noticed that dedicating time to properly analyzing my actions—both wins and losses—made my learning curve shoot up quickly. Connecting the dots started to bring solid results. An interesting experience… where will it take me and you in a year? Or two? Let’s find out.

Paul Nawrocki

3 min read

Day Trader's: First Things First

To start, I’ll give you a set of resources that I strongly recommend you get familiar with and use daily. Dedicate at least one hour each day to studying online content and learning (English, charts, concepts, indicators, etc.)

Paul Nawrocki

2 min read

How Beginner Day Traders Should Prepare Before Working With a Professional Broker

This guide explains how new traders should prepare before applying to a professional day trading broker, what buying power means, and how to meet the expectations that come with leverage.

Paul Nawrocki

4 min read

The Illusion of Control in Day Trading – Why It Misleads Traders

The illusion of control is a cognitive bias where people believe they have more control over events than they really do.

Paul Nawrocki

2 min read

Why day traders are unable to execute their own rules

Many day traders know exactly what they should do—set stop-losses, follow setups, respect risk—but in the heat of the moment they fail to execute.

Paul Nawrocki

2 min read

Why 90% of Day Traders Lose – and How to Be in the Other 10%

The difference between the 90% who lose and the 10% who succeed isn’t luck—it’s discipline, preparation, and mindset.

Paul Nawrocki

2 min read

Day Trader: If emotions run too high, step away from the screen

Step aside when fear stops you from following rules.

Paul Nawrocki

2 min read

Day Trader: The Psychology of Fear and Greed – How to Recognize and Control Them

Two powerful emotions—fear and greed—often decide whether a trader succeeds or fails.

Paul Nawrocki

2 min read

bottom of page